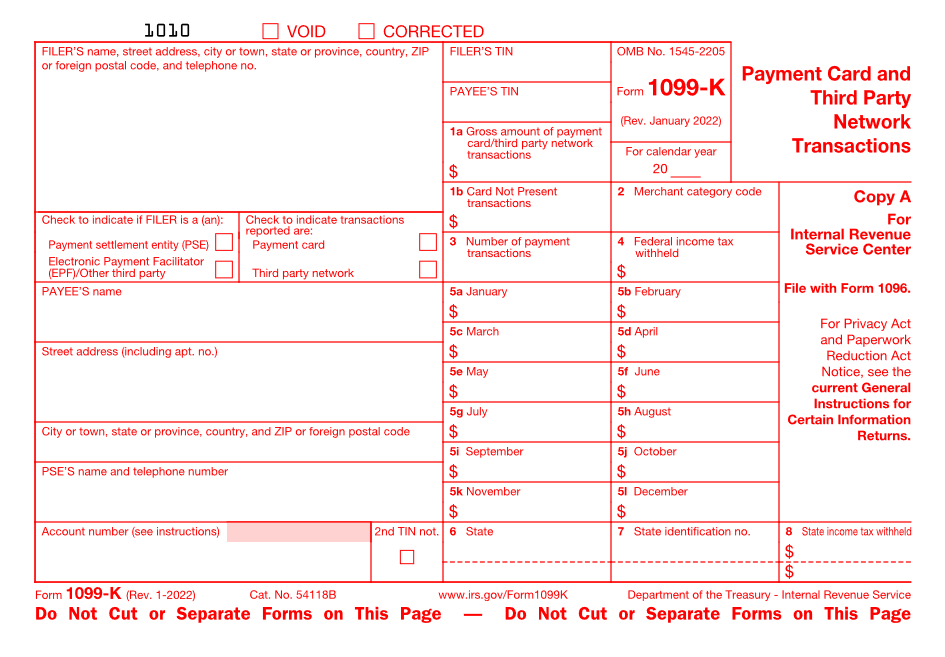

Revised: 01/2022 Instructions for Form 1099-K – Introductory Material What’s New Exceptions for reporting of third party network transactions. The reporting requirement for these transactions has changed from totals exceeding $20,000 to exceeding $600, regardless of the total number of transactions.

How to view and print Forms W-2 and 1099 – Help Center Home

File online File with a tax pro When are 1099-K issued? Platforms will send your 1099-K by January 31 each year. The form will cover all transactions made during the previous tax year. Depending on the options available from the platform, you may receive the 1099-K electronically or in the mail. What is a 1099-K used for? What do I do with it?

Source Image: chase.com

Download Image

Jan 11, 2024Update, November 29, 2023: The IRS is delaying the 1099-K threshold change for third-party settlement organizations (TPSO) like PayPal and Venmo. Taxpayers and small businesses will not receive a 1099-K from TPSOs for tax year 2023 (taxes you’ll file in 2024) unless they receive over $20,000 in payments from over 200 transactions. The IRS now

Source Image: kiplinger.com

Download Image

What Changes to Form 1099-K Should I Know? | HoneyBook 5 days agoThe IRS revised its frequently asked questions (FAQs) for Forms 1099-K, Payment Card and Third Party Network Transactions, replacing the existing FAQs with almost 50 new or updated ones. The new and updated FAQs, published in fact sheet FS-2024-03 on Tuesday, supersede FAQs published in a March 2023 fact sheet. The new FAQs are in addition to the recently updated webpage, “Understanding Your

Source Image: cpapracticeadvisor.com

Download Image

Select All That Apply. Who May Receive A Form 1099-K

5 days agoThe IRS revised its frequently asked questions (FAQs) for Forms 1099-K, Payment Card and Third Party Network Transactions, replacing the existing FAQs with almost 50 new or updated ones. The new and updated FAQs, published in fact sheet FS-2024-03 on Tuesday, supersede FAQs published in a March 2023 fact sheet. The new FAQs are in addition to the recently updated webpage, “Understanding Your Jul 5, 2023Taxpayer Rights What do I need to know? What is a Form 1099-K? Form 1099-K is an IRS information return. It contains information about the gross payments processed by the TPSO on behalf of the taxpayer. The TPSO files the Form 1099-K with the IRS, and the taxpayer receives a copy by January 31 of the following year.

Are You Ready for New 1099-K Rules? – CPA Practice Advisor

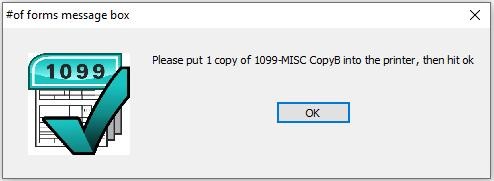

TPSOs, which include popular payment apps and online marketplaces, must file with the IRS and provide taxpayers a Form 1099-K that reports payments for goods or services where gross payments exceed $20,000 and there are more than 200 transactions during the calendar year. What to do if you receive a Form 1099-K FAQs Q1. How to Print 1099 Forms with CheckMark 1099 Software – CheckMark Knowledge Base

Source Image: kb.checkmark.com

Download Image

A Guide to Form 1099-K – TaxSlayer® TPSOs, which include popular payment apps and online marketplaces, must file with the IRS and provide taxpayers a Form 1099-K that reports payments for goods or services where gross payments exceed $20,000 and there are more than 200 transactions during the calendar year. What to do if you receive a Form 1099-K FAQs Q1.

Source Image: taxslayer.com

Download Image

How to view and print Forms W-2 and 1099 – Help Center Home Revised: 01/2022 Instructions for Form 1099-K – Introductory Material What’s New Exceptions for reporting of third party network transactions. The reporting requirement for these transactions has changed from totals exceeding $20,000 to exceeding $600, regardless of the total number of transactions.

Source Image: help.onpay.com

Download Image

What Changes to Form 1099-K Should I Know? | HoneyBook Jan 11, 2024Update, November 29, 2023: The IRS is delaying the 1099-K threshold change for third-party settlement organizations (TPSO) like PayPal and Venmo. Taxpayers and small businesses will not receive a 1099-K from TPSOs for tax year 2023 (taxes you’ll file in 2024) unless they receive over $20,000 in payments from over 200 transactions. The IRS now

Source Image: honeybook.com

Download Image

1099-K Forms: Reporting Requirements for 2023 Dec 10, 2022If you’ve accepted payments via apps such as Venmo or PayPal in 2022, you may receive Form 1099-K in early 2023, which reports income from third-party networks. For 2022, you may

Source Image: lili.co

Download Image

When Side Hustle Meets Schedule C: What Gig Workers Should Know About Taxes | PCMag 5 days agoThe IRS revised its frequently asked questions (FAQs) for Forms 1099-K, Payment Card and Third Party Network Transactions, replacing the existing FAQs with almost 50 new or updated ones. The new and updated FAQs, published in fact sheet FS-2024-03 on Tuesday, supersede FAQs published in a March 2023 fact sheet. The new FAQs are in addition to the recently updated webpage, “Understanding Your

Source Image: pcmag.com

Download Image

Print 1099 on Red Form: How to Adjust Printing Position Jul 5, 2023Taxpayer Rights What do I need to know? What is a Form 1099-K? Form 1099-K is an IRS information return. It contains information about the gross payments processed by the TPSO on behalf of the taxpayer. The TPSO files the Form 1099-K with the IRS, and the taxpayer receives a copy by January 31 of the following year.

Source Image: halfpricesoft.com

Download Image

A Guide to Form 1099-K – TaxSlayer®

Print 1099 on Red Form: How to Adjust Printing Position File online File with a tax pro When are 1099-K issued? Platforms will send your 1099-K by January 31 each year. The form will cover all transactions made during the previous tax year. Depending on the options available from the platform, you may receive the 1099-K electronically or in the mail. What is a 1099-K used for? What do I do with it?

What Changes to Form 1099-K Should I Know? | HoneyBook When Side Hustle Meets Schedule C: What Gig Workers Should Know About Taxes | PCMag Dec 10, 2022If you’ve accepted payments via apps such as Venmo or PayPal in 2022, you may receive Form 1099-K in early 2023, which reports income from third-party networks. For 2022, you may