Cashing Checks Made Payable to Your Business: A Comprehensive Guide

Once upon a time, I was a cash-strapped entrepreneur. A check made out to my business arrived, but I had no idea how to cash it. This sparked my journey to decode the enigma of check cashing for business owners.

In this definitive guide, we’ll delve into every aspect of cashing checks made payable to your business, from definition to the latest trends. So, whether you’re a seasoned pro or a novice entrepreneur, get ready to master the art of efficient check encashment.

The Art of Endorsing Business Checks

Endorsing a check is not merely a scribble; it’s a legal act signifying your authorization for payment. Two common endorsement types exist: blank and restrictive.

Blank endorsement: Sign the back of the check with your name. This makes the check payable to anyone who possesses it.

Restrictive endorsement: Specify the name of the person or entity to whom you want the funds transferred. For instance, you may write “Pay to the order of [Bank Name].” This ensures the check can only be cashed by the intended recipient.

Cashing Checks at Financial Institutions

Banks and credit unions are the most common destinations for cashing business checks. Here’s what you need to know:

- Present a valid business license or other proof of ownership.

- Endorse the check as discussed earlier.

- Provide identification, typically a driver’s license or passport.

Fees may apply, so inquire about charges before proceeding. Consider establishing a business account to simplify future check cashing processes.

Alternative Check Cashing Options

If traditional financial institutions aren’t your cup of tea, explore these alternatives:

- Check cashing stores: Convenient, but often charge higher fees.

- Online check cashing services: Deposit checks remotely using a smartphone app. Fees and processing times vary.

li>Mobile banking apps: Some banks offer check deposit features through their mobile apps.

Tips and Expert Advice for Efficient Check Cashing

Follow these expert tips to streamline your check cashing experience:

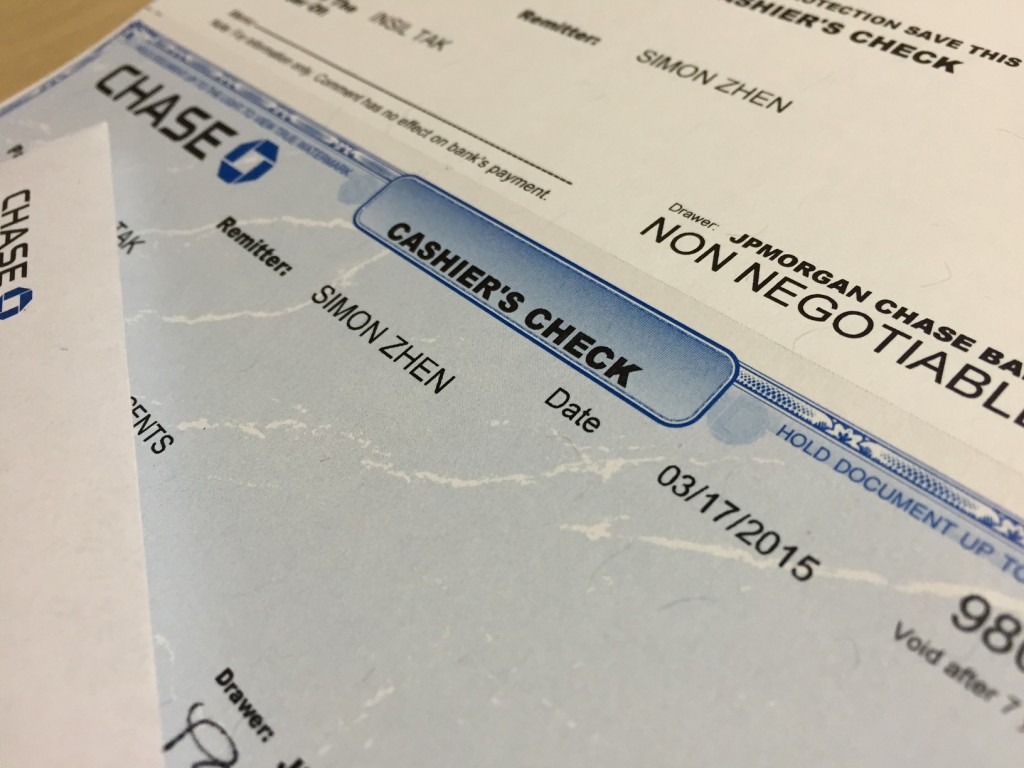

- Security first: Verify the check’s authenticity. Check for any alterations or discrepancies.

- Proper endorsement: Endorse the check correctly, using the appropriate method. Avoid any smudging or messy signatures.

- Accurate information: Ensure the check is payable to the correct business entity and filled out completely.

Remember, these tips are not exhaustive. Consult with your financial institution or an expert for personalized guidance based on your specific situation.

FAQs on Cashing Checks Made Payable to Your Business

Q: Can I cash a check if my business is not yet registered?

A: Yes, but you may need to provide additional documentation, such as a business license application or other proof of ownership.

Q: What happens if I lose a business check?

A: Notify your bank immediately to report the lost check and initiate a stop payment. File a police report for documentation.

Q: Can I deposit a business check into my personal account?

A: Generally, no. Depositing business checks into personal accounts may raise concerns about business income tracking and tax compliance.

Conclusion

Cashing checks made payable to your business is a crucial aspect of managing your finances. By understanding the concepts, following the tips, and exploring the various options, you can optimize your check cashing process. Remember, it’s not just about turning paper into funds; it’s about safeguarding your business and ensuring smooth financial operations.

Are you ready to embrace the art of business check cashing? Share your thoughts and questions in the comments below. Let’s navigate this financial landscape together!

Image: www.mybanktracker.com

Image: www.bankrate.com

How To Cash A Check At Walmart Under 18 Cashing business checks is different. While some payroll business checks may be easier to cash, how to cash a business check depends on some variables. If the check has been made out to your business rather than to you as the business owner, it may be harder to cash this business check. And, not all banks allow you to cash business checks made